Texas Cities Face Economic Crunch Amid Inflation and Budget Deficits

The landscape of Texas cities is changing rapidly as economic uncertainty looms. Despite the impressive population growth seen in cities like Fort Worth, whose population recently surpassed 1 million, local governments are grappling with significant budget deficits. Fort Worth is not alone; many cities and counties across the state are struggling to maintain essential services due to a cocktail of inflation, limited property tax collections set by state policy, and unpredictable federal funding.

The Strain of Economic Slowdown

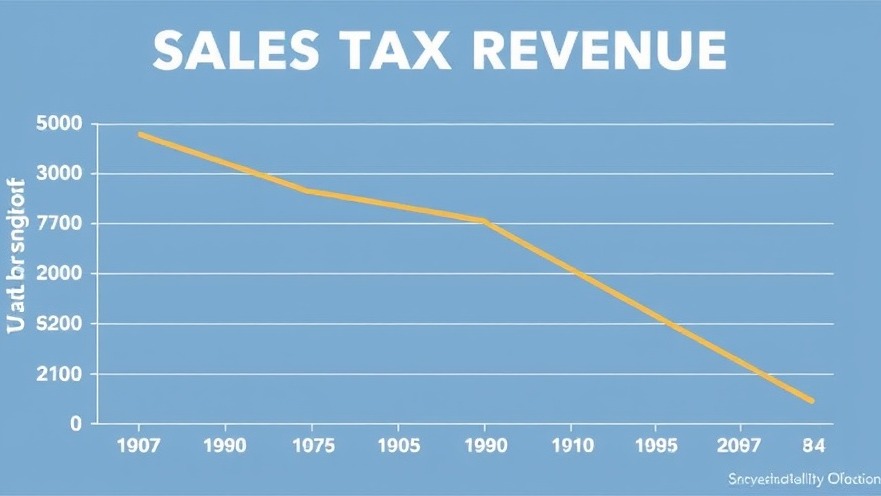

As Texas experienced a surge in population and economic growth in previous years, cities enjoyed a budget surplus mainly driven by sales tax revenue. However, this trend has taken a downturn as inflation rises and consumer spending habits change. Texas cities that once thrived on double-digit sales tax growth are now projecting a much more modest increase, with figures dropping below the pre-pandemic levels. For instance, Fort Worth expects only a 4% growth in sales tax revenue compared to the rapid growth rates during fiscal years 2021 and 2022.

Understanding Sales Tax Dynamics

Sales tax revenue has a direct impact on local budgets, funding vital services like police, fire departments, and public infrastructure. In Austin, the city is already seeing flat sales tax collection this year, following a peak growth of 21% in 2022. The shift in spending priorities is notable, as residents are now allocating more of their income to necessities such as housing and food, which do not contribute to sales tax revenue.

Future Predictions: What Lies Ahead for Texas Cities?

Local government officials worry that without newfound sources of revenue, they will be forced to implement painful budget cutbacks. The continuation of strict state funding regulations and the lingering impacts of federal tariff policies add layers of complexity to the budgetary landscape. For many cities, potential future shortfalls loom large, necessitating either drastic cuts in essential services or raising taxes and fees that could burden residents further.

Local and Statewide Implications

The economic challenges facing Texas cities could influence broader state policies. As local governments attempt to stabilize their budgets, citizens may witness changes in how their taxes are assessed and local services delivered. Community engagement and transparency in budgetary decisions will be critical as residents will want to understand how local governments are navigating through these difficulties while keeping essential services intact.

Take Action: Staying Informed

Residents should stay informed about Texas economics and local budget decisions as they directly affect community well-being. Understanding where tax dollars are allocated can empower citizens to advocate for themselves and contribute to discussions on economic policy and local governance.

Add Element

Add Element  Add Row

Add Row

Write A Comment